We are Manhattan New York condo specialists, we work with many out of town and oversea investors often asked about Manhattan New York condos. Often we are asked by our buyers of series of questions that are regards to the unique Manhattan New York condo markets. We will be answering these frequent asked questions and hope to help other buyers who are interested in buying or investing in Manhattan New York condominiums.

One of the common asked question by our out of town investor buyers: Who can help me rent out and manage the condo once I own it? This is a good question, we work with many out of town and oversea investor buyers that also asked the similar question because they are not Manhattan New York based and would like a full range of service. We as Manhattan New York condo specialists, we not only assist our clients sell, buy, invest their Manhattan New York condos, we also facilitate in securing a qualified tenant for their investment property. Once the condo is closed and owned by our buyers, we begin to market the condo as a rental property, answer to rental requests and appointment, qualifying the perspective tenant to ensure they are financially qualified and suitable for the condo. The fee for this service will be case on case basis. Manhattan New York rental brokerage marketing fee is 15% of the first year rent, though depending on the location of the condo, rental price and other key factors, we can discuss in details.

Managing the Manhattan New York condo, depending on clients needs, there are different options. Option one would be the owners manage the tenant and the condo by themselves, this is easy to do especially with Manhattan New York condo, there is a building staff and maintenance department a phone call or email away. Option two, we will be able to handle the property management in terms of being client’s contact person here in Manhattan New York, we will be collecting rent from the tenants, handling questions and inquiries and etc. There will be a fee in involved in this, as based on each clients’ need, we can discuss different packages we offer.

DO YOU HAVE A QUESTION IN REGARD TO MANHATTAN NEW YORK CONDOS? Email us!

- HOW TO MAKE AN OFFER in Manhattan New York Condominium Market?

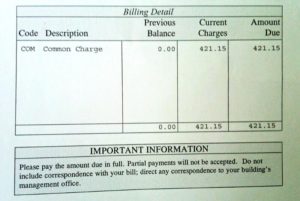

- What is Common Charge in Manhattan New York Condominium Market?

- International students’ parents buy Manhattan NYC Condos

- Foreigner Buy NYC Condos-FAQ

EMAIL US TODAY: https://manhattannycondosforsale.com/contact/

If you or someone you know would like to buy or sell Manhattan New York condominiums, please call us directly today at (917) 837- 8869 or (646) 644- 6929. We specialize in Manhattan New York condominium market and have experiences selling Manhattan New York condos in different neighborhoods, we offer confidential consultation customize to your specific investment needs.

and to a 8.97% New York State estimate income tax on the net sales proceeds (gains).

and to a 8.97% New York State estimate income tax on the net sales proceeds (gains).