Manhattan NY Condos FAQ: What is Common Charge in Manhattan New York Condominium Market?

Common Charge often is abbreviated as “CC” in many of Manhattan New York property listings. Common charge is also known as Home Owner Association Dues in other parts of the country in United States.

In Manhattan New York condominium market, each owner of the condo unit are responsible for the monthly Common Charge. Depending on each condo buildings policies and rules, these common charges usually includes the salary of the building staff, operational expenses of the condo common space such as hallway, elevator, lobby, amenities(if any), each units water, gas usage, cool and hot air (although this may vary depending on the building).

In the scenario of a Manhattan cooperative(Co-Op), there will be a “Maintenance charge” instead of “common charge”. Please note that there is a difference between Maintenance charge and common charge due to the differences of cooperative and condominiums. “maintenance charge” usually is a total sum of the monthly cost of that particular cooperative unit, which includes the allocated shared building carrying cost, real estate taxes of the cooperative unit, underlying mortgage of the cooperative and etc. Manhattan New York condominiums common charge does not include any Real Estate taxes or underlying building mortgage.

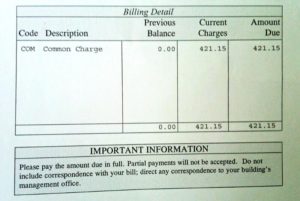

Common Charge usually is billed by the condo management on the monthly basis. If the owners preferred, they can make an arrangement with the condo management to pre-paid the common charge if the owner is not Manhattan local based or will be traveling for a period of time.

If the owner of condominiums uses this Manhattan NY condo as an investment or rental property, then the owner of the condo is responsible to pay for the monthly common charge not the tenant. It is also advisable that the owner stay in charge paying the common charge instead of the perspective tenants, otherwise in case of the default of common charge by the perspective tenant, the owner may be liable for additional penalty cost or other serious consequences enforced by the condo management.

If you or someone you know would like to buy or sell Manhattan New York condominiums, please call us directly today at (917) 837- 8869 or (646) 644- 6929. We specialize in Manhattan New York condominium market and have experiences selling Manhattan New York condos in different neighborhoods, we offer confidential consultation customize to your specific investment needs.

and to a 8.97% New York State estimate income tax on the net sales proceeds (gains).

and to a 8.97% New York State estimate income tax on the net sales proceeds (gains).